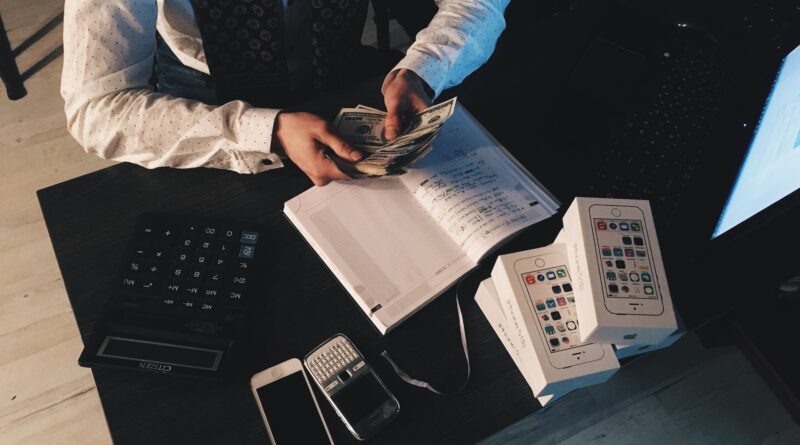

Unexpected Business Expenses and How to Limit Them

If you run a small business, then you have to make sure that you are budgeting for everything properly. If you’re not then you could be making a major mistake, because your business won’t be as efficient as it could be. One way for you to work around this would be for you to keep track of the money you have coming in while making sure that you’re not overspending on unexpected expenses.

Equipment Repairs

Equipment often provides a crucial function within a business. You can’t run your coffee shop without having a commercially-graded coffee machine. You also can’t run your moving company if you don’t have a fleet of trucks. Unfortunately, equipment tends to break down, and this bill can be costly. If you want to help yourself here then one thing you can do is invest in an appliance management solution. By doing this, you can then make sure that you are always one step ahead.

Supply Costs

Another expense you may face is supply costs. With inflation reaching a record high, it’s safe to say that your supplies probably cost more now than they did last year. While you can shop around to try and get the best price, you will probably have to pay a higher amount and then adjust your budget moving forward. Price increases can be very difficult to predict, but if you can have an open conversation with your supplier then you will be able to plan accordingly. It may be that you have to raise your rates too, so be mindful of that.

Professional Fees

If you are a business owner, then you are probably an expert within your community. With that in mind, you may not be knowledgeable in every single area of your business. You might not be as good as you could be at filing taxes or claiming for expenses. Using a professional service can be a great solution here, but at the same time, it can be costly. One way for you to work around this would be for you to hire a freelancer. When you do, you can count on them to help you with any jobs you need, without a contractual obligation.

Employees

Payroll really should be a major part of your monthly budget. Hiring and retaining employees can come with some hidden expenses that you might not have accounted for. It may be that you need to go through a recruitment service to help you find some good candidates, or that you need to provide a certain employee with training so that they can take on more roles. Things like this can be costly, so you need to make sure that you account for them properly. One way for you to work around this would be for you to try and forecast any expenses and then take steps to prepare for them. Putting a set amount away to cover employee training is always a good idea, for example, so be mindful of that if you can.